Publications

California Budget Challenge 2021

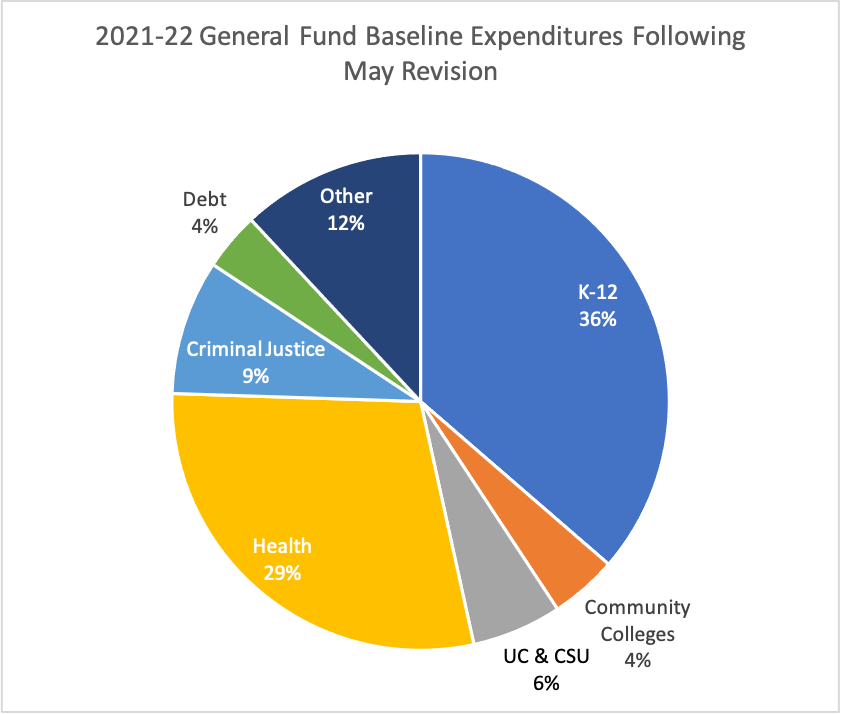

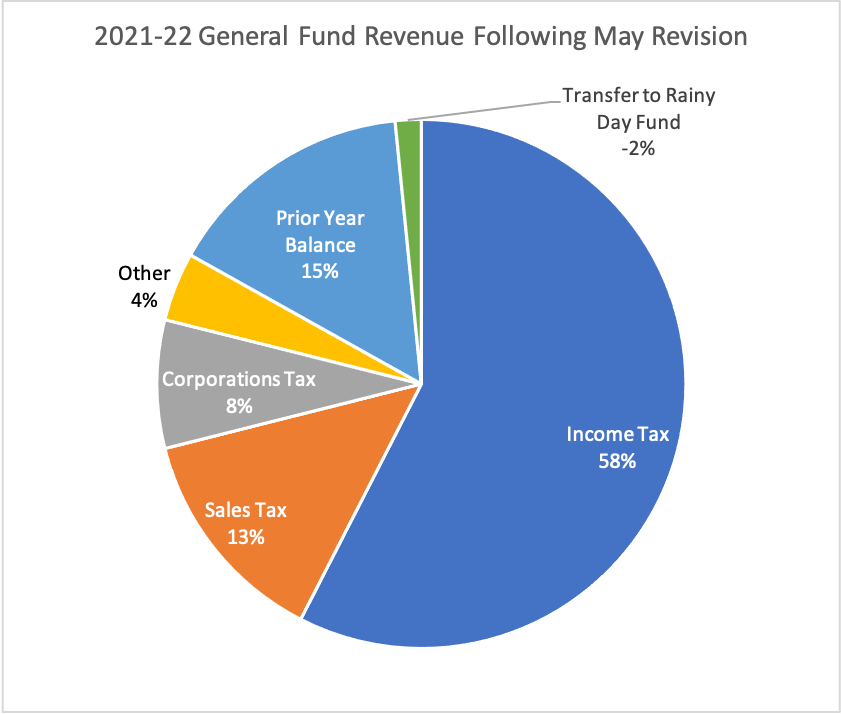

Governor Newsom released his proposed budget for fiscal year 2021-22 on January 10, 2021 and released the May Revision to the proposed budget on May 14, 2021. As a result of the COVID-19 pandemic, the state government expected to continue experiencing a budget deficit in 2021-22. However, General Fund revenues were higher than expected—due to the fact that most state revenue comes from income taxes and high-income earners were less impacted by the pandemic than lower-income earners—and costs related to the pandemic were lower than expected—due to federal assistance such as enhanced unemployment insurance benefits—when the 2020-21 budget was passed in June 2020. The federal government also passed the American Rescue Plan in March 2021 which directed an estimated $150 billion total to California—$26 billion of which was direct aid to the state and $16 billion of which went to local governments in California (more information on California's share of American Rescue Plan funds available here). Due to these factors, the LAO estimated that there was a surplus of approximately $38 billion in discretionary funds in 2021-22 following the May Revision.

The Legislature passed a number of measures in the spring of 2021 to provide funds to respond to the pandemic, fuel economic recovery, and address longer-standing challenges. The Legislature passed AB 86, which directed $6.6 billion to K-12 schools to address learning loss and enable school re-openings. The Legislature also passed SB 74 that provided $2.6 billion to establish the Keep California Working Grant program to provide economic relief to small businesses and nonprofits impacted by the pandemic. Lastly, the Legislature passed a wildfire package that provided $536 million to address wildfire prevention and resilience issues in the face of what is predicted to be a severe wildfire season as a result of the ongoing drought.

As a result of one-time surplus of $38 billion in 2021-22, the May Revision included a number of proposals using federal and state funds to help Californians recover from the pandemic. Of the $38 billion surplus, the Governor has proposed dedicating $25 billion to one-time or temporary spending, $7 billion to revenue reductions, and $2 billion to ongoing spending (though these would grow substantially over time). The Governor and the Legislature passed a placeholder budget by the constitutional deadline of June 15, 2021, while the details were still being negotiated. The final budget package was announced on June 28, 2021 ahead of the start of the 2021-22 fiscal year on July 1, 2021.

The largest spending proposals from the Governor's May Revision and final budget are listed in the Key Findings tab, along with information about alternative proposals. Budget Basics are on the Additional Resources tab and provide more in-depth information on each of the spending categories,

Major One-Time or Temporary Spending:

- Golden State Stimulus: $8.1 billion of federal funds to provide provide another round of Golden State Stimulus payments of $600 to approximately 9.4 million Californians with incomes of $75,000 or less that did not receive a payment in the first round.

- All families with at least one dependent who earn $75,000 or less (an estimated 4.3 million tax filers) would receive a $500 payment (some families will receive $1,100 if they also qualify for the $600 payment).

- All ITIN taxpayers with adjusted gross income of $75,000 or less and a dependent would receive $500, assisting an estimated 520,000 tax filers.

- Community Schools: $3 billion one-time funds to be used by 2028 to enable as many as 1,400 school district and charter schools to transition to community schools

- Student Housing: $2 billion in one-time funding to create a new fund that would be used over a 4-year period to build new campus facilities or support the development of affordable student housing at UC and CSU

- Homelessness & Affordable Housing: $12 billion over two years, including: $1 billion each year to local jurisdictions to combat homelessness; $1.75 billion to build backlogged affordable housing projects; $300 million to preserve existing affordable rental housing; and $130 million to build and maintain farmworker housing

- Includes $3.5 billion to continue property acquisitions through the Homekey Program, formerly called Project Roomkey, in which property, such as hotels and motels, are acquired and converted into housing for the homeless

- Rental Assistance: $5.2 billion of federal funds to provide rental assistance to those who owe back-rent as a result of lost income due to the COVID-19 pandemic and extension of the eviction moratorium to September 30, 2021

- Water Infrastructure: $700 million General Fund in 2021-22 ($2.8 billion over 4 years) to improve the state's water infrastructure, drought response, and capacity to adapt to changing conditions

- Clean Energy: $912 million General Fund to accelerate the California's progress toward meeting its clean energy goals and position California as a leader in innovative clean technologies

- Wildfire Resilience: $708 million one-time (on top of $536 million package passed in spring 2021) to enhance wildfire resilience across California’s diverse landscapes by thinning forests, replanting trees, prescribed burns, and other forest resilience measures

- Broadband: $6 billion over multiple years to fund broadband infrastructure with $3.75 billion specifically to increase access in under- and un-served areas of the state

- Deferrals: $1.45 billion to repay all of the community college late payments (i.e., deferrals) from 2020 and $11 billion to repay all of the deferrals at K-12 schools

Major Ongoing Spending:

- Universal School Meals: $54 million in 2021-22 to provide all K-12 students free school meals (breakfast at lunch), with ongoing cost growing to $650 million annually beginning in 2022-23

- Universal Transitional Kindergarten (TK): $250 million in 2021-22 to expand access to all 4-year-olds by fall 2025 with an ongoing cost of $2.7 billion Prop. 98 funds annually once fully implemented

- Expand Medi-Cal Access: $67.3 million ($48 million General Fund) in 2021-22 to expand access to Medi-Cal to all adults aged 50 and older regardless of immigration status beginning May 1, 2022, with an ongoing cost of $1.5 billion ($1.3 billion General Fund) once fully implemented

- Governor Newsom proposed expanding access to adults aged 60 or older at a cost of $69 million ($50 million General Fund) in 2021-22 and an ongoing cost of $859 million General Fund once fully implemented

- Fine & Fee Debt Forgiveness: $12.3 million General Fund, increasing to $58.4 million ongoing, to expand a program that allows indigent and low-income individuals to apply online to have their fines and fees from traffic infractions reduced in accordance with their ability to pay

- The Legislature proposed $300 million one-time federal funds for this purpose