Publications

Designing Electricity Rates for An Equitable Energy Transition

California’s current strategy of recovering a myriad of fixed costs in electricity usage rates must change as the state uses more renewable electricity to power buildings and vehicles on the path to carbon neutrality. That’s the finding of Designing Electricity Rates for An Equitable Energy Transition, a new report from Next 10 and the Energy Institute at the UC Berkeley Haas School of Business.

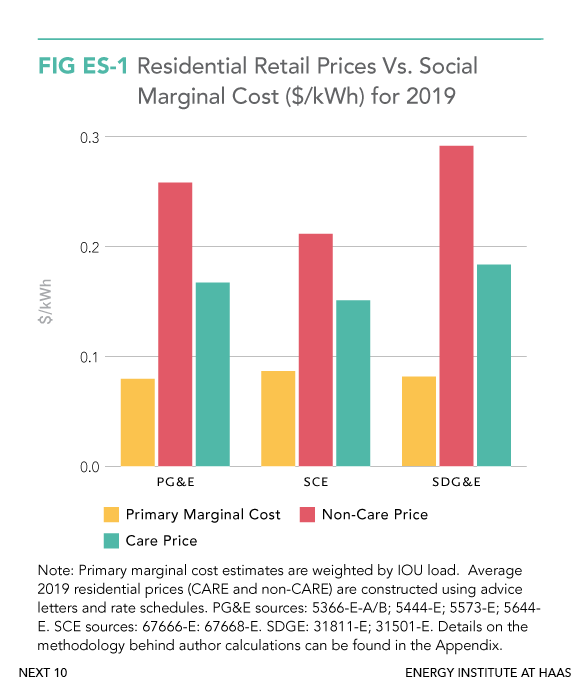

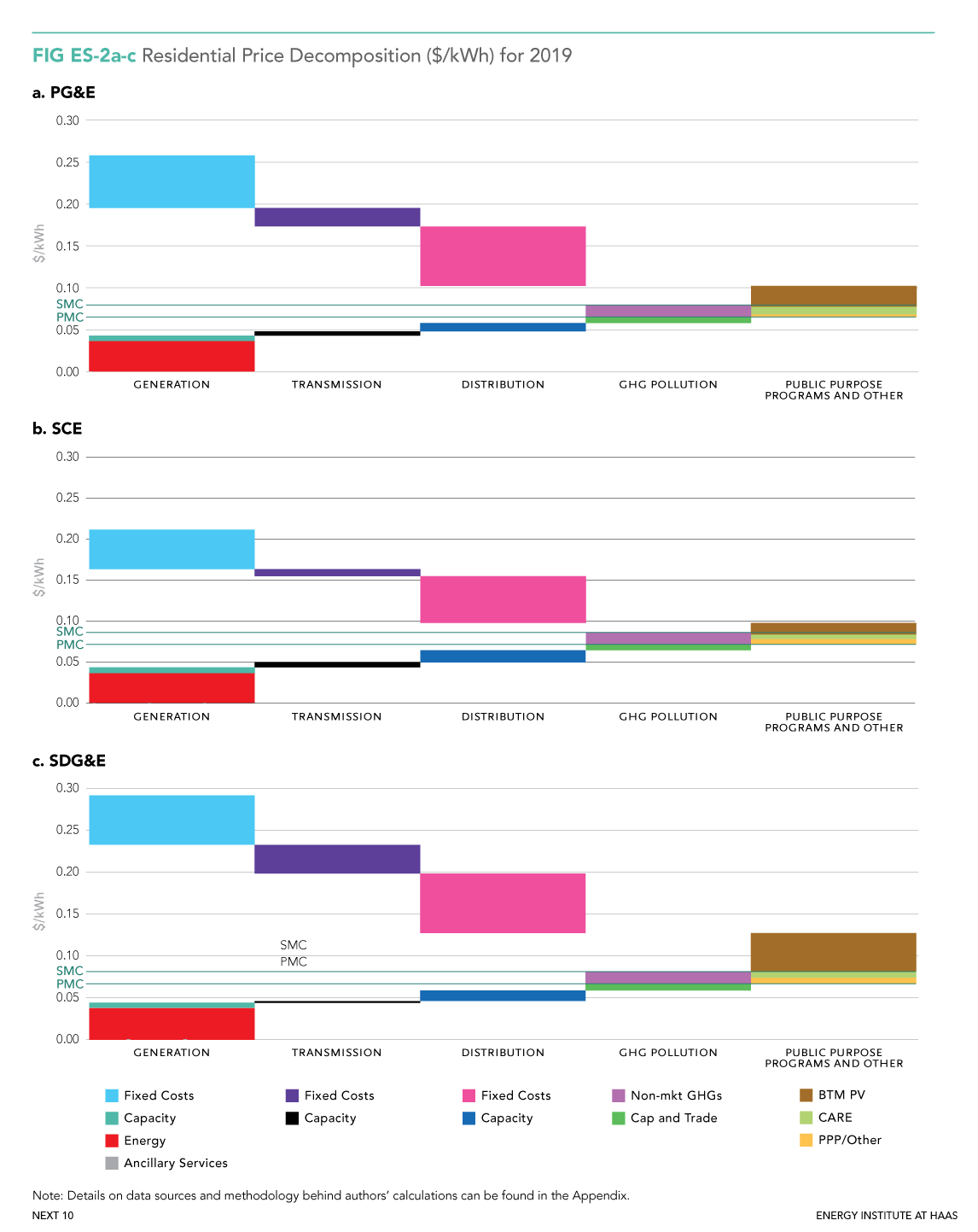

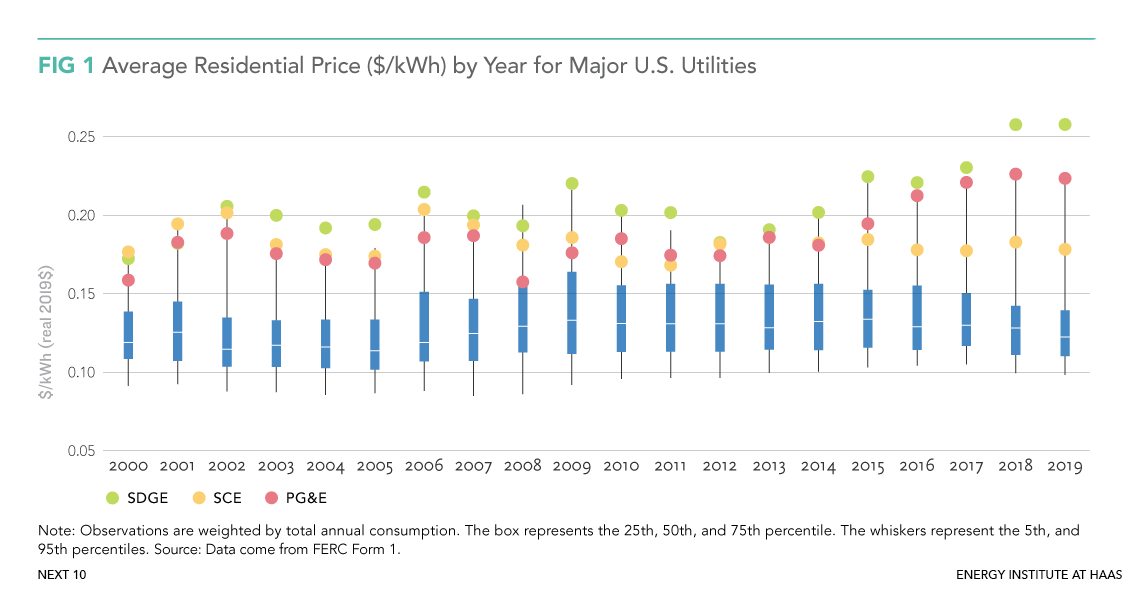

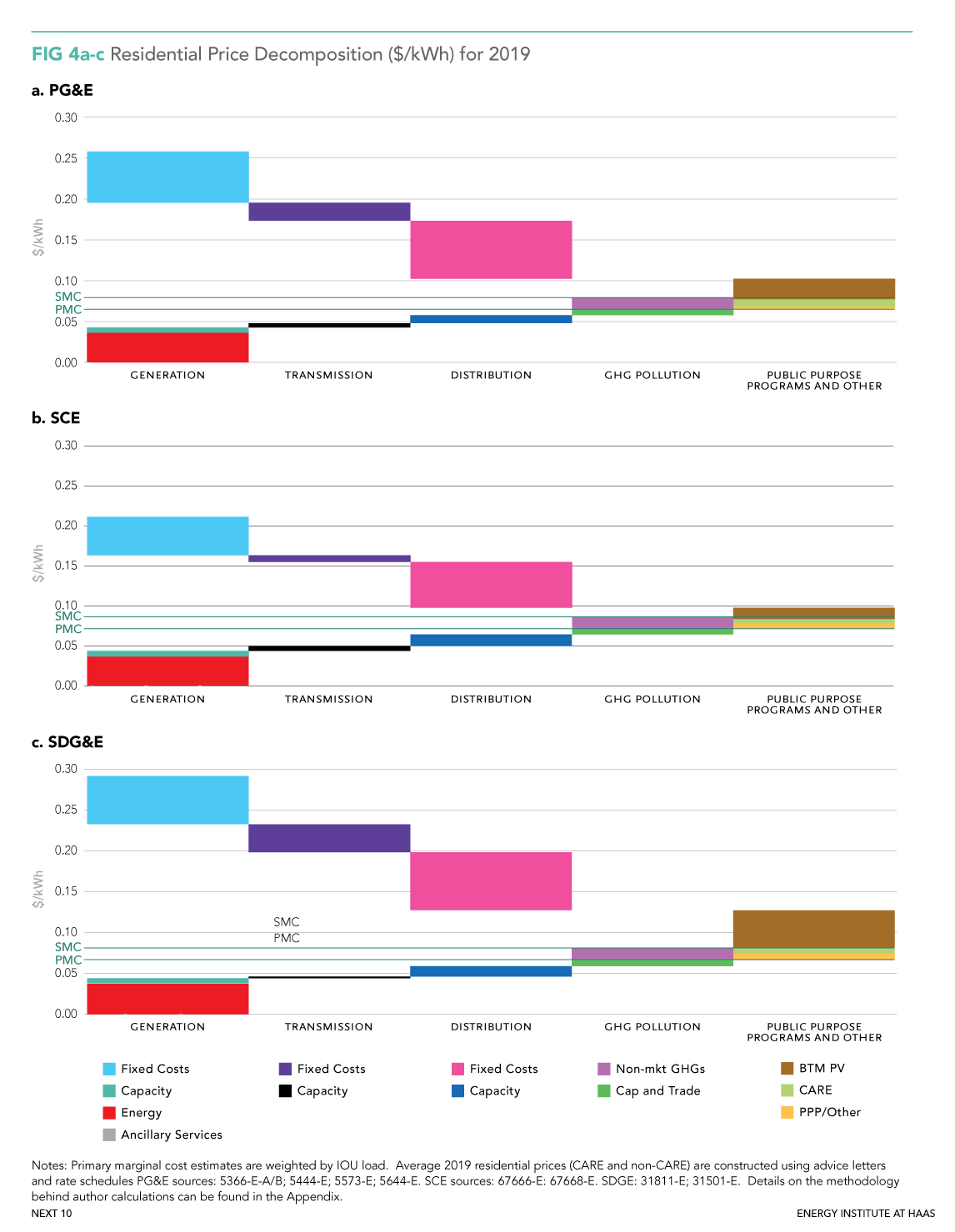

Data from the report reveal that the state’s three largest investor-owned utilities (IOUs)—PG&E, SCE, and SDG&E—charge residential electricity customers much higher prices than are paid in most of the country—prices that are two to three times higher than the actual cost to produce and distribute the electricity provided. These high prices result from uncommonly large fixed costs that are bundled into kilowatt-hour prices and passed on to customers. These costs cover much of the generation, transmission and distribution fixed costs, as well as energy efficiency programs, subsidies for houses with rooftop solar and low-income customers, and increasing wildfire mitigation costs.

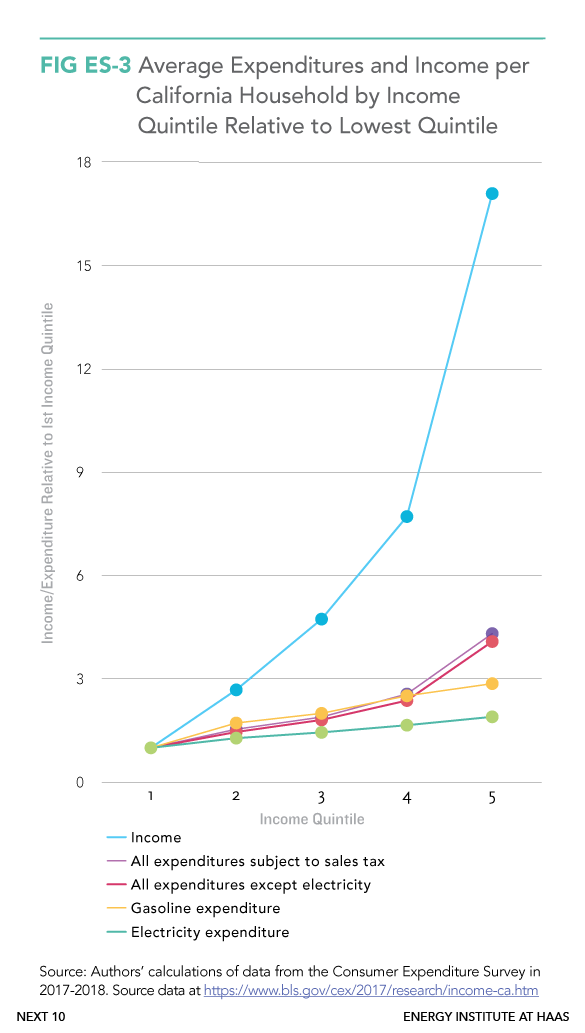

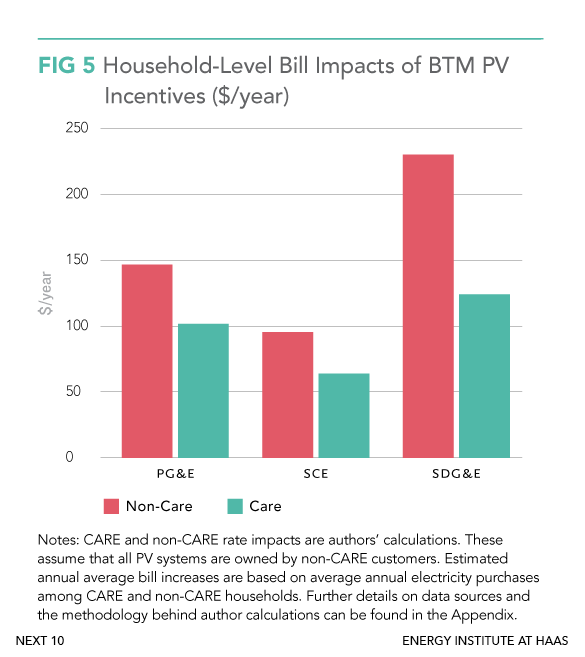

Compounding concerns over these high costs is the inequity of their distribution: as wealthier households transition to rooftop solar, the fixed costs are distributed through a smaller volume of kilowatt-hours delivered, raising the costs even more for remaining, lower-income customers at a time when an increasing number of Californians are struggling to pay their utility bills. About eight million residents currently owe money to investor-owned utilities, according to a recent presentation by the California Public Utility Commission.

This is especially concerning as rates are projected to rise again due to wildfire-related costs. Earlier this month, IOUs unveiled a plan to spend $15 billion over the next two years to prevent wildfire ignitions. The researchers found that while wildfire prevention programs are likely to be a major driver of price increases in the near future, there is a significant lack of transparent data on the total costs and how they are being passed on.

Next 10 is not the sole owner of rights to this publication. Usage of this content is subject to permissions, please contact us at info@next10.org for more information.

Featured Graphics

- California IOUs’ prices for electricity are out of line with the rest of the country.

- In the least expensive territory, Southern California Edison (SCE), residential prices per kilowatt-hour are about 45 percent higher than the national average. Prices for Pacific Gas & Electric (PG&E) are about 80 percent higher, and prices in the San Diego Gas & Electric (SDG&E) territory are roughly double the national average.

- These prices are two-to-three times the cost of providing the electricity, due largely to the burden of recovering fixed costs that don’t reflect the cost of providing addition power for electrification.

- From 66 to 77 percent of the costs that IOUs recover from ratepayers are associated with fixed costs of operation that do not change when a customer increases consumption.

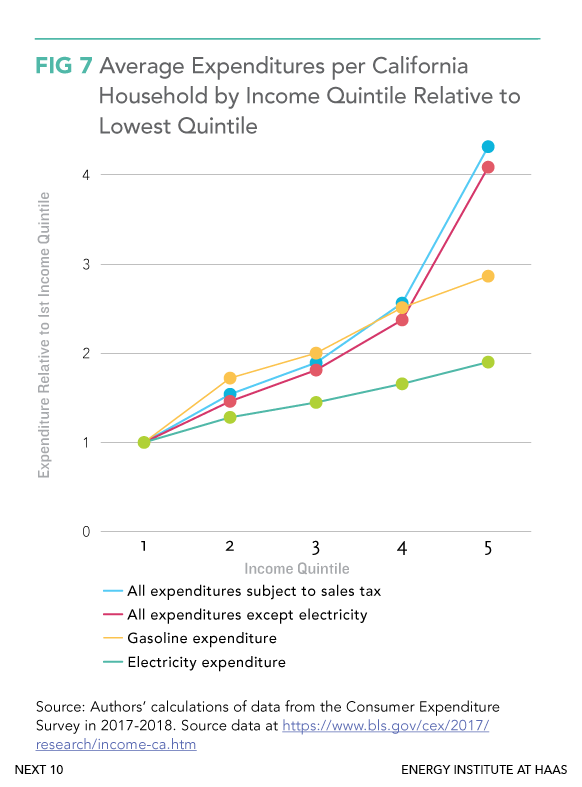

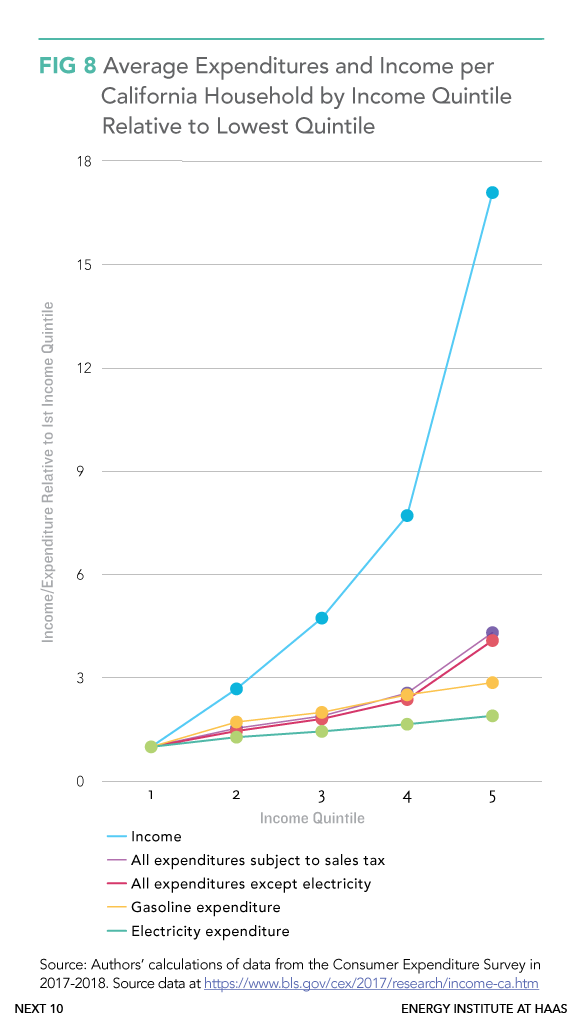

- Lower- and middle-income households bear a greater burden. These households are increasingly responsible for covering high fixed costs as total consumption from the grid declines. Due largely to increasing rooftop solar ownership in wealthier households, higher-income customers now purchase only modestly more electricity than lower-income households (despite higher electricity demands), leaving lower-income earners to pay an increased share of the fixed costs.

- A more equitable model would recover costs from sales or income taxes, or an income-based fixed charge. The report suggests potential changes to how utility fixed costs, as well as and environmental and low-income program costs, are recovered, including:

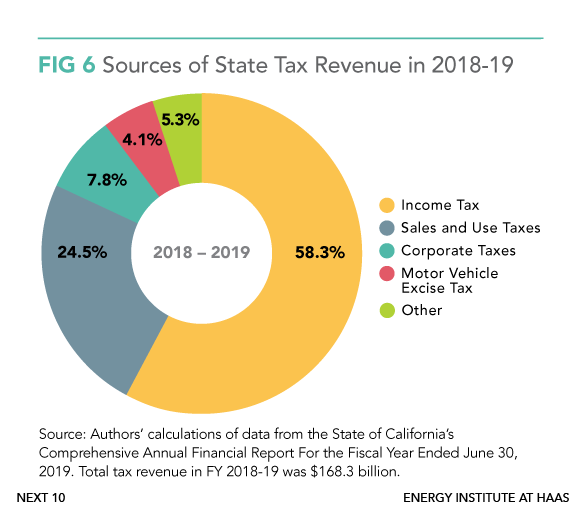

- Tax revenue: Raising revenue from sales or income taxes would be much more progressive than the current system, ensuring that higher-income households pay a higher share of the costs.

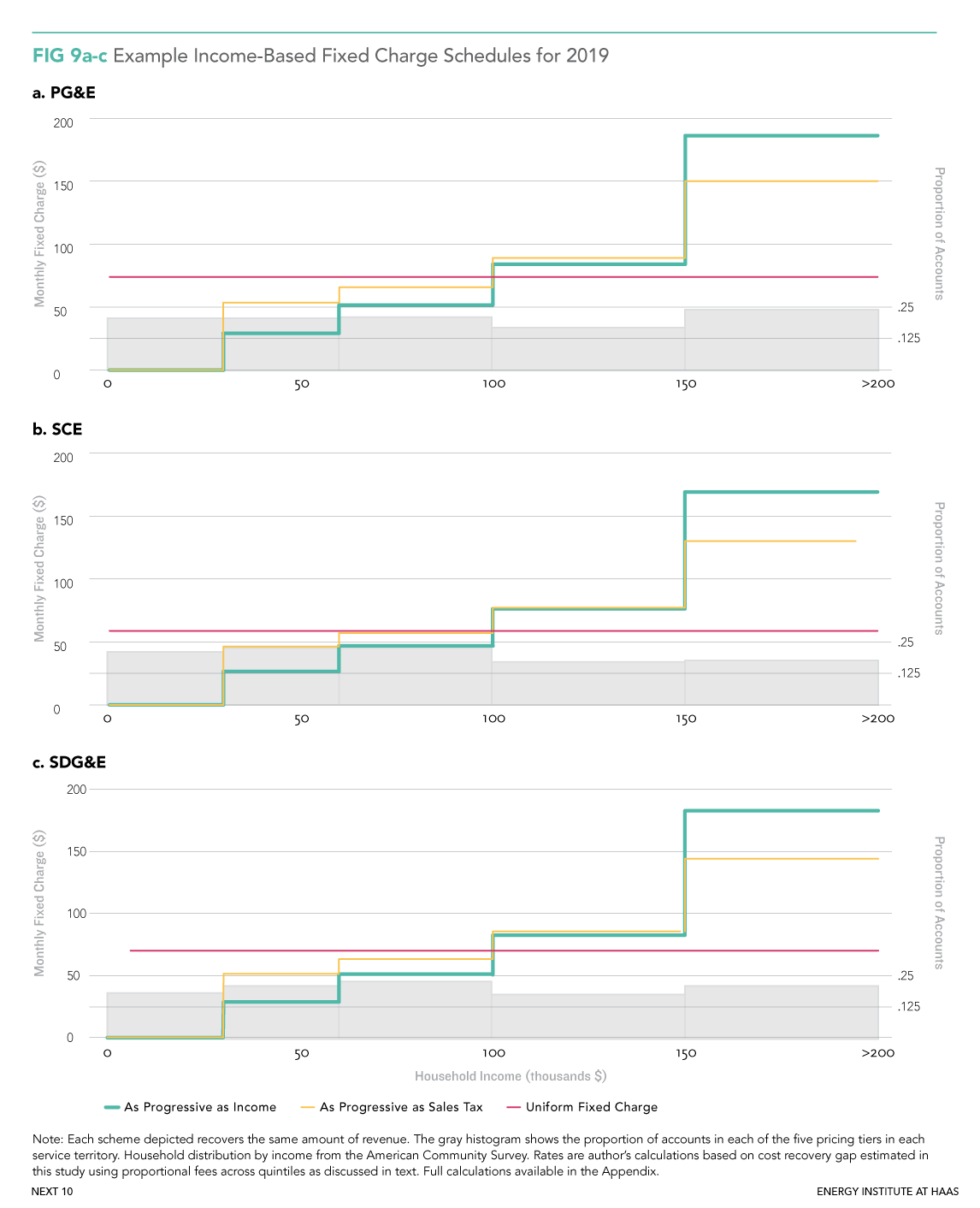

- Income-based fixed charge: A potentially more politically feasible option could be rate reform—moving utilities to an income-based fixed charge that would allow recovery of long-term capital costs, while ensuring all those who use the system contribute to it and also keeping costs affordable for all families. In this model, wealthier households would pay a higher monthly fee in line with their income. The report examines a variety of implementation options for this model.

Next 10 cannot grant permission to use graphics from this publication; additional permissions may be required from the copyright holder. Please view our Terms of Use policy for more information or contact Next 10 at info@next10.org with any questions.